Strategy 2:

Implement Wealth Management

Strategy 2 Contents

1. The Affluent Market

2. The Nine High-Net Worth Personalities

3. The Five Key Financial Concerns of the Affluent

4. The Six C's of Client Loyalty

5. The Four Business Models

6. Wealth Management Formula

7. The Compelling Logic of The Wealthy Client Pipeline

8. Bringing Two Powerful Business Drivers Together

9. Conducting Discovery, Step By Step

10. Components of an Effective Agreement

11. The Thought Leadership Process

Resources

A key element in gaining clarity about the practice you want is being extremely clear about your business model.

An important aim of The Elite Wealth Manager is helping you implement the wealth management business model at a very high level, potentially even at the elite level.

Here in Strategy 2, we set the stage for you to become an elite wealth manager by exploring some of the most important aspects of today’s affluent market along with crucial characteristics of affluent individuals, including high-net-worth personality, major financial concerns and what they want from their financial advisors. We then put that in context within the four major business models used by financial advisors, and give you an important tool for effectively communicating your value as a wealth manager.

1. The Affluent Market

We begin with a look at the affluent market overall, including the various levels of affluence and the size and growth of the affluent market in the United States today.

Levels of Affluence

Some financial advisors tend to treat all clients and prospective clients largely the same. However, the affluent can be very different from those of more moderate wealth. Even more important, affluent clients at varying levels of wealth can differ significantly from one another in their goals and what they want and need from their advisors.

In The Elite Wealth Manager, we define three distinct levels of affluence, ranging from the affluent who hold investable assets in the range of $1 million to $5 million; the super affluent who have between $5 million and $25 million in investable assets; and the ultra-affluent, who have more than $25 million in investable assets. (See Exhibit 2.1.)

Many financial advisors focus on the mass affluent—a group we define as having between $100,000 and $1 million in investable assets. While this might appear to be an attractive market at first glance, it has clear limitations. It is exceedingly difficult, if not impossible, to profitably provide a comprehensive wealth management experience to clients with this level of investable assets, particularly those at the lower end of this range. To make a significant impact on your clients’ lives, on your practice and on your own quality of life, you will need to serve clients with more wealth.

For a great many financial advisors, the affluent stratum represents the “sweet spot” for clients and prospective clients—the one where they can most effectively add substantial value to their clients’ financial lives. For this reason, we will focus on those in the affluent category throughout The Elite Wealth Manager. The wealth management client experience you will build throughout this program will meet the needs of clients at this level extremely well.

In contrast, individuals and families in the two upper strata, particularly the ultra-affluent, frequently present financial challenges of such complexity that they are better addressed in a traditional or virtual family office setting. This is also often the case with people with a net worth of $10 million or more—even when they have investable assets of less than $5 million. As you perfect your wealth management practice, you may choose to continue to move up market to serve clients at these higher levels of affluence. Roundtable, CEG Worldwide’s mastermind group of elite wealth managers, is devoted to a great extent to helping advisors attract and serve clients at these higher levels.

A Word About the Super Rich

We will make reference from time to time to the Super Rich, which we define as individuals and families with a net worth of $500 million or more. We do this not because we recommend that you pursue Super Rich clients, as the needs of virtually all of these clients are best addressed in institutional or elite single-family office settings. Instead, we will share insights from the Super Rich in their approach to managing their money and their lives when they are applicable and useful to clients of much less wealth and to you as their advisor.

The Size and Growth of The

Affluent Client Market

There has been substantial growth in the number of affluent individuals in the United States since the economic downturn of 2008-09. As Exhibit 2.2 shows, the number of individuals with investable assets of at least $1 million nearly doubled from 2.9 million in 2009 to 5.3 million in 2018.

Likewise, the overall amount of wealth of those with investable assets of at least $1 million nearly doubled in the 2009-2018 period, growing from 2.9 trillion to 5.3 trillion, as you can see in Exhibit 2.3.

There are approximately 420,000 financial advisors working in the United States right now. With 5.3 million individuals with $1 million or more in investable assets, that works out to an average of over 12 affluent clients per financial advisor—if the playing field were level.

But the playing field is not level, nor do we want it to be. We want you to have an unfair competitive advantage in order to attract much more than your share of affluent clients to your practice. You will gain this competitive advantage through The Elite Wealth Manager.

Resources

2. The Nine High-Net-Worth Personalities

9 High-Net-Worth Personlities

While demographic data gives us an understanding of the opportunities in the affluent market, they do not tell us everything we need to know about who the affluent really are and how you can serve them best.

To determine the right affluent clients for your practice, and then to employ the systems that will consistently meet their particular needs well, you have to go deeper. You need to understand what we call “high-net-worth psychology”—a framework for understanding what affluent individuals want from their money and their financial advisors.

High-net-worth psychology will help you answer many questions about the affluent: Why do they switch financial advisors? Why do they prefer some services and products over others? Why do some have many financial advisors and others only one? Why do they choose the financial advisors they do?

Resources

In the Tools section of this strategy, you will find two interactive resources for getting the most from your knowledge about high-net-worth personalities:

-

High-Net-Worth Personality Self-Diagnostic Quiz—Determine your own high-net-worth personality as well as which personalities are most compatible and profitable.

-

High-Net-Worth Personalities Refresher—Test and reinforce what you know about the high-net-worth personalities.

High-net-worth psychology is applicable to every aspect of attracting and retaining the affluent. It will enable you to more effectively connect with the right prospective clients and then to build healthy, long-term relationships with your affluent clients. By using it, you will communicate better, obtain more qualified introductions and acquire more assets to manage. In short, high-net-worth psychology will underpin every part of your success in your work with affluent clients.

High-net-worth psychology revolves around an understanding of the nine personality types of affluent individuals. The original research identifying these nine personalities was conducted more than a decade ago by CEG Worldwide’s director of research at the time, Russ Alan Prince. This landmark study was—and still is—one of the most comprehensive and relevant examinations ever done of the affluent. It changed how we deliver the wealth management experience and continues to inform the best practices of serving the affluent.

Exhibit 2.4 provides an overview of the most important needs, values and motivations of each personality.

As you can see from Exhibit 2.5, Family Stewards make up the largest group of affluent individuals, at 34.1 percent. The second-largest group is Independents, at 16.8 percent.

We will now take a look at each different personality type in a little more depth.

1. Family Stewards

“Good financial management lets me take good care of my family.”

The largest group of affluent individuals, Family Stewards’ primary financial concerns are about taking care of their families. Most of their financial goals and needs are linked to larger family issues such as paying for college or transferring wealth to the next generation. They are average in their knowledge of wealth management.

To work with Family Stewards, you need to demonstrate expertise, which they define as being able to provide the services that will enable them to best fulfill their chief goal of caring for their families. You also need to show that you are prudent and careful in order to work well with Family Stewards. They need to feel that you are very protective of them and value their goal of protecting their families exceptionally well.

Family Stewards are highly responsive to a variety of advanced planning services because of their motivation to do the best by their families. They readily understand why planning would put them in a better financial position. As a result, they are very interested in estate and financial planning, and most are very interested in asset allocation services.

Family Steward Case Study

A financial advisor was introduced by one of his affluent clients to an affluent individual who had a daughter, Mary, who had muscular dystrophy. From their first meeting, it was clear that everything in this person’s life revolved around how he was going to take care of his daughter. The advisor quickly realized that the prospective client was a Family Steward whose financial goals centered on the well-being of his daughter. They developed an appropriate wealth management plan, and every time financial decisions were addressed, the advisor prefaced the discussion by saying, “Here is how this is going to help Mary.”

Shortly after they began working together, the client began to provide unsolicited introductions to prospective clients. These prospective clients were also affluent people with children who had muscular dystrophy. As it turned out, the client belonged to an association for families with children with this condition, and the client was so pleased with the detail and care taken on behalf of his child that he urged other parents to go to his financial advisor.

2. Independents

“To me, successful financial management means freedom.”

Independents are straightforward: They want the freedom to do whatever they want, and they seek to achieve this freedom through financial security. While they may hold corporate jobs or run businesses, they dream of financial freedom that would allow them to pursue hobbies or travel full time.

Independents are average compared to the other groups in terms of their financial knowledge and sophistication, and they will turn to you to compensate for their lack of expertise. They define this expertise as an ability to provide financial advice that will enable them to achieve financial freedom.

Because they understand the importance of allocating their assets wisely but generally do not do a good job doing so themselves, they are interested in asset allocation services. Because they typically retire early and know how important it is to keep their money working, another important area of interest to Independents is retirement distribution planning.

Independent Case Study

Carolyn, a chief engineer at an aerospace company, had a 401(k) plan into which she had put money for many years. Her company matched her contributions and also offered a profit-sharing plan. Carolyn decided to look at her options and began talking with a couple of financial advisors.

One of them realized that Carolyn was an Independent. Acting on this insight, this financial advisor began every meeting with Carolyn by emphasizing that the key objective was to figure out the best way for Carolyn to take her distributions so that she would never have to worry about money again. The financial advisor convinced Carolyn that he understood her personal goals and was rewarded with a $3.2 million IRA rollover account.

3. Phobics

“The last thing I want to talk about is my money.”

Because they so dislike dealing with money, Phobics are hard to miss. They do not understand money nor do they want to learn about it. Instead, they much prefer delegating the management of their financial affairs to a trusted wealth manager. Because they have little financial knowledge or sophistication with which to judge an advisor, they do so emotionally, going with their “gut feelings.”

For you to succeed with Phobics, they must see you as a reliable and dedicated authority. To them, this means being able to take care of all their financial matters and being dedicated to their best interests. With little interest in investing, Phobics—of all the nine personalities—are both the least knowledgeable about and the least sensitive to investment performance.

While most Phobics do need advanced planning services, they are not interested in participating in an extensive financial, estate, investment or tax planning process. This creates a challenge: to get them to commit to a process that they need but do not want to participate in.

Phobic Case Study

One advisory firm that has adopted catering to Phobics as the core of its business. As the market steamed ahead at a double-digit pace in recent years, the firm returned an average annual return of less than 5 percent.

In spite of these returns, the firm has not lost a single affluent client. In fact, it grows its client base by more than 25 percent annually. Because of the firm’s success in growing its account base, three years ago it instituted a $2 million minimum for new accounts.

This advisory firm is located in Florida and focuses on widows whose money has come from life insurance as its primary clientele. Whenever the financial advisors have client meetings, they talk mostly about personal issues—Medicare, grandchildren, golf. They touch on financial issues only briefly. In fact, this accounts for their success with affluent clients. The advisors focus almost exclusively on developing and enhancing personal rapport, not on the nuts and bolts of wealth management.

4. Anonymous

“My money is my business and no one else’s.”

The Anonymous are intensely private people who do not want to disclose their financial positions to anyone. While this clearly represents a challenge—it will take some time before the Anonymous will provide you with information—it can also be a plus. In part because the Anonymous do not want to talk to anyone else, they tend to be loyal to advisors who have won their trust.

In order to work with a wealth manager, the Anonymous need to feel absolutely confident that their privacy will be preserved. Thus, they choose advisors who understand this and communicate the steps taken to ensure confidentiality. To work effectively with the Anonymous, you must be extremely discreet and miss no opportunity to emphasize the lengths to which you will go to protect client information.

Because they are so tight-lipped about their holdings, many of the Anonymous have not been through basic estate and tax planning processes. If you can secure their trust, these advanced planning services are appropriate for the Anonymous.

Anonymous Case Study

Alex was referred to a financial advisor by his attorney. The financial advisor consulted initially by phone and set up a meeting. One of the first things Alex told the financial advisor was that he hated taxes. Alex also said he thought that the Internet made personal information too easy to access.

After a few questions, the financial advisor determined that Alex was one of the Anonymous. He told Alex he thought his concerns about privacy were justified and that confidentiality of all interactions was a priority. He then asked Alex where he would like to meet in the future in order to ensure privacy. Alex said he preferred his office. During the meeting, the financial advisor emphasized his security measures in all dealings with clients and was rewarded with Alex’s account.

Alex has been a client of this financial advisor for seven years, although they meet infrequently. Because of Alex’s concerns about Internet security, they exchange documents only by messenger. Alex has rewarded his financial advisor with a 60 percent increase in assets over the initial account, totaling $6.8 million.

5. Moguls

“Being rich means power.”

Moguls are motivated by power. They seek control, influence and power in their families, businesses, communities and finances. While they do have some financial knowledge, they are not interested in it per se but regard it as another forum for flexing their power and control.

To successfully work with Moguls, you must acknowledge their power and be powerful yourself. At the same time, you must understand that they want to be in total control of the relationship. This means that you must be appropriately deferential and that you must emphasize ways in which they have control over their financial affairs in terms of making the big decisions.

Moguls find the idea of asset allocation very appealing because it means they can have control over their investments without having to be involved in the day-to-day details. And because they see themselves as important, prominent people who may be likely targets for lawsuits, they are interested in wealth protection.

Mogul Case Study

Bob was a partner in a very successful law firm. He and his wife had a daughter and a son. A year ago, Bob had a stroke. Although he fully recovered, he was still worried about his health as well as his family’s financial well-being. His daughter continually maxed out her credit cards, just like her mother, whom he blamed for this behavior. His son had problems with drug and alcohol abuse and had never been good with money.

Bob felt he had no one he could trust, and he wanted to make sure his family did not fritter away all his money. He decided he needed to structure his estate so that his wife or kids would not lead themselves into financial ruin after he was gone. He felt that he was the only one strong enough to ensure his family’s financial well-being.

Bob’s financial advisor was sensitive to his psychology and control issues. He helped Bob structure an estate plan that addressed his concerns and met his control needs.

6. VIPs

“There are lots of ways to get respect, and having money is one of them.”

VIPs are status-oriented, enjoying prestige and the respect of others. VIPs are the type of affluent people who look rich, and wealth management for them is about the ability to buy status and possessions.

VIPs are not especially knowledgeable about finances and will rely on you as a wealth management expert. To relate well to VIPs, you need to be particularly attentive and responsive. You should especially stress the reputation and prestige of your institution or firm.

VIPs often already have financial or estate plans and therefore are not very interested in them. Instead, because they see themselves as minor celebrities who need to protect themselves from lawsuits, their strongest interest is in wealth protection services. They are also interested in charitable giving because they see donations to various causes as a way to elevate their social standing.

VIP Case Study

An affluent client introduced a prospective client named Victor to her financial advisor. The financial advisor used high-net-worth psychology to determine that Victor was a VIP. Over the course of several phone conversations, it became clear that Victor already had a number of financial advisors. There was nothing really motivating him to open a new account with this advisor.

The advisor approached Victor with a game plan to develop a private foundation in his name and positioned it to appeal to the VIP profile. He did so by pitching the private foundation as “the way people of your stature give.”

Victor became intrigued, especially after the advisor showed him certain tax advantages. After almost a year of discussion, Victor had become so pleased by the advisor’s service that he transferred just shy of $3 million for discretionary management to this advisor. High-net-worth psychology enabled the financial advisor to get a foot in the door, which in the end led to greater assets under management.

7. Accumulators

“You can never be too rich or too thin, but being rich matters more.”

Accumulators save more than they spend, tend to live well below their means and do not exhibit any outward displays of wealth (and have a disdain for those who do). What they do enjoy is watching their money grow. The more they have, the better they feel. Capital appreciation is an end in itself.

To work with Accumulators, you have to continually repeat back to them their goals and motivations. They are performance-driven and expect you to be the same way—concentrating on piling up those assets and congratulating each other on successful performance results.

Accumulators are open to various advanced planning services, especially if those services will result in more money. Asset allocation services are also attractive to them because the point of asset allocation is to maximize long-term results.

Accumulator Case Study

A financial advisor had a physician client with an account worth more than $5 million. The physician did not particular care about protecting her family, saying, “Why should I leave it to them? They didn’t work for it.” She didn’t care about power or yachts or freedom. All she cared about was watching her money grow, and she was consistently critical of her financial advisor.

The physician constantly asked why the funds the financial advisor chose did not beat this or that fund. The financial advisor would reply that no one can pick the leading fund year after year. Then he would try to educate the doctor about investing and why returns fluctuated. Nevertheless, the doctor would become angry. The financial advisor realized he had an Accumulator on his hands.

With that high-net-worth psychology insight, the financial advisor soon understood he was doing the wrong thing in trying to educate his client on the nuts and bolts of investing. So instead, he began every meeting, conversation and sentence with, “This plan is what is going to give you the most money over our ten-year plan.” By doing so, he took the client’s focus off the year-to-year returns and kept it on the long-term plan for maximizing gains. He has kept the client for six years and counting.

8. Gamblers

“You have better odds playing the market than at Vegas.”

Gamblers love the excitement and drama of investing. For Gamblers, investing is a hobby. For some it is their work, and for a few it is their life. Because of this, they are more performance-sensitive than any other group. While they are very knowledgeable about investing, they are not always astute. They believe, for example, that it is possible to consistently beat the market. Not surprisingly, they often have a higher-than-usual risk tolerance.

Gamblers love to find people with whom they can talk about investing and need their wealth managers to be as involved as they are. They like their wealth managers to share in the emotional excitement of investing and want them to have the same level of investing expertise.

Most Gamblers are not particularly interested in having someone approach them with advanced planning services unless such services are truly state-of-the-art.

Gambler Case Study

For one financial advisor, the majority of his clients are Gamblers. Like his clients, his life is the market. His enthusiasm, coupled with his knowledge, makes him ideal for working with Gamblers.

In meeting an affluent prospective client, he requires less than five minutes to determine if the person is a Gambler. When the person is a Gambler, getting the business is a slam dunk. Why? Because the financial advisor and the prospective client are immediately on the same wavelength. Rapport is instantaneous.

One of his clients, who has about $40 million under management—half in a managed account and the other half for trading—talks to him almost every day. Even when the client goes on vacation, he calls every day. Both of them relish the excitement of the markets, which makes the relationship work.

9. Innovators

“Derivatives are the best thing that ever happened.”

Innovators are extremely knowledgeable and like to be at the cutting edge of wealth management. They like new products, innovative services and sophisticated analytical methods. They often have technical backgrounds and might be computer programmers, engineers or mathematicians.

To earn the trust and assets of Innovators, you have to prove your worth in terms of leading-edge product expertise. It is not unusual for Innovators to run sophisticated analytical software on their own.

Like Gamblers, Innovators are interested in only the most sophisticated planning services. If you conduct an asset allocation analysis, you should be prepared to review with them the various assumptions built into the model with which you are working.

Innovator Case Study

Robert is a computer scientist who made millions designing industry-specific enterprise software. In fact, his core software program is one of the most widely used packages of its kind. His software has made him extremely wealthy.

Robert is a self-proclaimed nerd. He is interested in the mathematics of money management, and his primary financial advisor is similarly focused. Critical for the financial advisor is her ability to discuss everything from Sharpe Ratios to the efficient frontier. In fact, she dissects every investment along these lines.

It took Robert a long time to find a financial advisor who was technically astute enough to keep up with him. Being as knowledgeable as he is, why does Robert need to employ the services of a financial advisor? First, he requires someone to help him think through the issues. Second, he needs someone to bring him the latest thinking in the field. Third, he needs someone who is tied in to Wall Street and can implement his investment desires.

Working with Innovators requires a high degree of technical sophistication. Those financial advisors who recognize affluent individuals as Innovators and can keep them on the cutting edge will be greatly rewarded for their efforts.

3. The Five Key Financial Concerns of the Affluent

We now arrive at the most critical knowledge you can have about the affluent: their most important financial concerns. Affluent clients want to work with true authorities: financial advisors who can help them make informed decisions to solve their most pressing financial challenges. When you know what those challenges are and can articulate them succinctly, you are ready to position yourself as the optimal financial advisor for your prospective clients.

As with our understanding of the high-net-worth personalities, we initially identified the major concerns of the affluent during a foundational study by Russ Alan Prince. The findings of that research have been re-confirmed many times since the initial study. As we have coached thousands of financial advisors who serve affluent clients, we have heard the following five major concerns repeated over and over again.

1. Wealth Preservation

Above all else, the affluent are concerned about losing their wealth. Despite their wealth, they are not immune to financial setbacks. But wealth preservation is not only about not losing money—it’s about having enough money to fund their lifestyles, whether simple or extravagant.

The goal of wealth preservation is to produce the best possible investment returns consistent with the client’s time frame and tolerance for risk. This is the primary area of focus for most financial advisors. As a wealth manager, investment management will be only the foundation of the value you provide to affluent clients. As you will see, you will also help them to address their other four key financial concerns.

2. Wealth Enhancement

Wealth enhancement is about tax mitigation: minimizing the impact of taxes on clients’ investment returns while ensuring the cash flow they need.

We have seen that mitigating incomes taxes is one of the major financial concerns of the great majority of affluent individuals and families. Mitigating estate taxes and capital gains taxes also ranks high on their list of concerns.

It’s no surprise that so many affluent share these tax-related concerns. Taxes can—and do—eat up a great deal of wealth. As a wealth manager, you will help your clients enhance their wealth by minimizing this impact.

3. Wealth Transfer

Effective wealth transfer is all about taking care of heirs: finding and facilitating the most tax-efficient way to pass assets to loved ones in ways that meet the client’s wishes with minimal difficulty and cost.

Given the fluid nature of today’s tax environment, affluent families need to be proactive in their wealth transfer planning efforts if they truly want their wealth to benefit their heirs to the fullest extent possible. As a wealth manager, you will help them do so.

4. Wealth Protection

This includes all concerns about protecting the client’s wealth against catastrophic loss, potential creditors, litigants, children’s spouses and potential ex-spouses and identity thieves—in short, ensuring that their assets are not unjustly taken.

Many affluent individuals are worried about being sued—not surprising, given how litigious our culture has become. This means that as a wealth manager, you will likely need to address controlling risks through business processes, employment agreements and buy-sell agreements, as well as restructuring various assets and considering legal forms of ownership—such as trusts and limited liability entities—that will help put your clients’ wealth beyond the reach of creditors and other parties who may seek to take it.

5. Charitable Giving

Many affluent individuals are looking outward beyond their own families to the world at large. For these people, making meaningful gifts to charity in the most impactful way possible is a key issue.

Charitable giving comes with its own unique set of challenges—from selecting the appropriate means of giving (such as direct gifts, donor-advised funds or private family foundations) to selecting causes and specific organizations that will have the biggest impact. As a wealth manager, you will help your charitably-minded clients to navigate the charitable planning process.

Wealth preservation, wealth enhancement, wealth transfer, wealth protection and charitable giving: This list will become very, very familiar to you as build and position your business to serve the affluent in your niche community. In fact, your ability to effectively address each of these key financial concerns will become the bedrock of your value promise to your affluent clients and prospective clients.

Resources

4. The Six Cs of Client Loyalty

We turn next to the six core characteristics that clients want in their financial advisors.

These are the characteristics that build authentic client loyalty. Loyal clients will be incredibly important to your practice, as they will provide you with the lion’s share of your introductions to qualified prospective clients and of additional assets to manage.

1. Character

Character is about the personal qualities clients want in their financial advisors. Integrity is perhaps the most important quality, but trust and dependability also rank extremely high.

But you can’t just tell your clients that you are honest, trustworthy and dependable. You have to demonstrate your good character through your actions. The best way to do this is through the quality of your conversations with your clients. And the highest-quality conversations you can have with your clients are about their values. You will find out exactly how to have these conversations in Strategy 5: Nail the Wealthy Client Experience.

Resources

2. Chemistry

Chemistry is the ability to be “in sync” with your clients. You have chemistry when you connect with them—you know what they want to talk about and you see eye-to-eye on important issues.

Your discovery process will be the key to demonstrating this quality to your clients. When you have conducted a thorough discovery process—and this will be about much more than just financial issues—you will understand what they care about most so that you can connect with them on a fundamental level.

3. Caring

You must be genuinely concerned about your clients’ well-being. They should be more important to you as people than making money.

It isn’t enough to just care, however. You have to be able to show clients that you care. Your best opportunity for doing this, again, will be during your discovery process. Your discovery will uncover not just your clients’ financial issues, but also their most important relationships, interests, goals and dreams. If your discovery process stops short of uncovering what’s most important to your clients, you will fail to communicate that you truly care about what’s most important to them.

4. Competence

Competence is about being smart, technically capable and an authority in solving the financial challenges of your niche community. But being competent is not enough; you must demonstrate your competence. In Strategy 7: Become the Expert the Wealthy Want, you will discover a system for communicating your competence in compelling and effective ways.

5. Cost-Effectiveness

Being cost-effective means you deliver true value to your clients for the cost of your services and products. Do not confuse cost with value. Affluent clients are generally willing to pay premium prices, but only when they believe you are worth the cost.

How do you demonstrate to your affluent clients that you are cost-effective? By addressing their entire range of financial concerns, including those beyond investment management. By doing so, you have the potential to provide peace of mind, which is simply the highest value that you can offer as a financial advisor.

6. Consultative

This is the most important of the six factors. When you are consultative, your client relationships are framed as ongoing partnerships over time. This makes it the most effective characteristic for building client loyalty.

While many financial advisors talk about being consultative, in our experience a true consultative approach is relatively rare. There are three central components to a consultative approach:

-

Cooperative orientation. Most affluent clients want to work with their financial advisors in a collaborative relationship. Do not make the mistake of assuming that they just want you to hold their hands and take care of everything for them. Instead, work with your affluent clients. Not only will you address their challenges more effectively, you will win their loyalty.

-

Contact. You will build the loyalty of your affluent clients by contacting them appropriately—on both financial and non-financial matters. While it should be self-evident that clients want to be contacted about their financial affairs, the advisors who are most successful in building loyalty know that their clients want contact on noninvestment issues as well. It is this type of contact—when you and your clients discuss family issues, current events and the like—that fosters the close interpersonal relationships that are crucial to client loyalty.

-

Customized communications. In general, the affluent are looking for customized communications tailored to their specific preferences. To build true client loyalty, you need to understand how clients want to be contacted, how often they want to be contacted and what they want to be contacted about. Uncovering this information will be one part of your new discovery process.

The Client Loyalty Framework

The six factors work together in building client loyalty, but some are more important than others. According to our experience and observations, character, chemistry, caring and competence provide the foundation, together accounting for about half of client loyalty. Cost-effectiveness adds another 10 percent. The consultative factor is far and away the single most decisive, accounting for 40 percent of client loyalty.

As you will see again and again, high-quality client relationships will be extremely important to your success as they will be the source both of qualified introductions and additional assets. The wealth management process you will implement beginning with Strategy 5 has been designed specifically to foster trusted, long-lasting relationships with your clients.

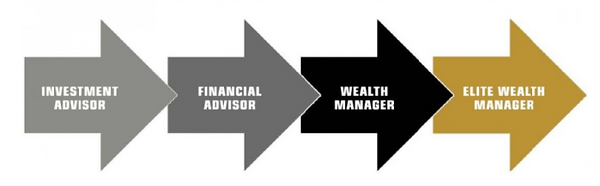

5. The Four Business Models

9 High-Net-Worth Personlities

Investment Advisor

If the foundation of your practice today is delivering investment management expertise, you are classified as an investment advisor. Your client discovery focuses on investments because you are looking for how to manage your clients’ financial assets. Also, your product platform enables you to offer various money management products.

Financial Advisor

If you are a financial advisor, you are an investment advisor who has incorporated limited planning services into your practice. Planning services range from foundational to extremely sophisticated; in our definition of financial advisors, those planning services tend to be more on the foundational side. Your client discovery process continues to concentrate on investable assets. However, you also have discussions that produce planning solutions.

Wealth Manager

The advancement from investment advisor to financial advisor is incremental. In contrast, it’s usually a game-changing transition when financials advisors become wealth managers. The biggest difference is that wealth managers take a holistic financial approach to their affluent clients. This requires a comprehensive client discovery process. The Total Client Profile that you will master in Strategy 5: Nail the Wealthy Client Experience is one proven way to develop a wide-ranging and inclusive profile of clients.

The wealth manager’s product platform on the investment management side is the same as that of an investment advisor or financial advisor. However, wealth managers add advanced planning products and services.

Elite Wealth Manager

Upgrading one more step brings us to the elite wealth managers. These financial professionals mirror wealth managers when it comes to practice orientation and client discovery process. However, they are incrementally superior when it comes to their deliverables. Whereas wealth managers can deliver basic advanced planning capabilities, elite wealth managers can provide complete advanced planning.

Resources

In today’s hyper-competitive environment, if you’re not moving forward, you’re probably moving backward. The good news is that no matter where you are now, you already have the foundation in place for moving to the elite level.

Exhibit 2.7 sets out the broad enhancements needed to transition to the next level. The Elite Wealth Manager will

support your enhancements in every part of your practice.

6. Wealth Management Formula

Resources

7. The Compelling Logic of the Wealthy Client Pipeline

Financial advisors have long sought to bring in new wealthy clients through strategic relationships with other professional advisors, most notably attorneys and accountants. You may have endeavored to do this already. If you are like many financial advisors we’ve worked with, your results were less than stellar. The reason is usually simple math.

A typical arrangement between advisors and other professionals involves trading clients. In theory, it works like this: You provide an attorney with a client for an estate plan, and the attorney recommends you to one of his or her wealthy clients. In reality, however, it rarely works like this. How many of your wealthy clients need new estate plans, compared with the number of new wealthy clients you would like to get? The balance is nearly always off—and not in your favor.

Another arrangement involves sharing revenue in return for wealthy client referrals. Unfortunately, almost all attorneys cannot or will not share revenues. At the same time, a substantial percentage of accountants will not use this approach. Furthermore, even when you can find a professional who will share revenue, over time this approach tends to lose value as the affluent clientele of the other professional is tapped out.

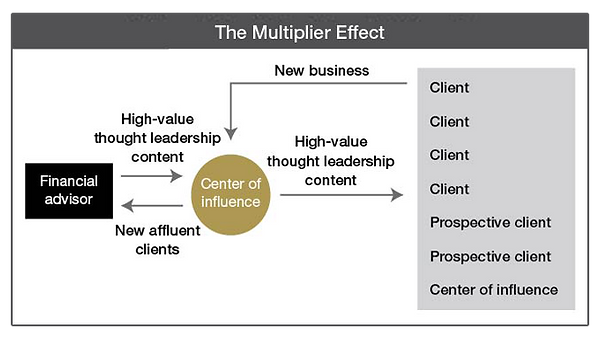

However, there is one approach that does work—and perhaps phenomenally so, when implemented fully. That approach involves helping your attorney and accountant partners bring in significant new business and seriously build their practices by becoming thought leaders to the wealthy. In return, these partners will do something that they are inclined to do and that is easy for them to do: provide you with a steady stream of referrals to qualified affluent clients—your wealthy client pipeline. The chart below shows exactly how this works.

In contrast to the other approaches, this works because it gives these professionals meaningful assistance in the area that tends to be their greatest weakness: business development. You will help them where they need help the most and, just as important, where they will likely never stop needing your help. And the more you help them, and the more successful they become, the more wealthy client referrals you will likely receive.

8. Bringing Two Powerful Business Drivers Together

The wealthy client pipeline brings together two of the most potent drivers of business for financial advisors: thought leadership and strategic partnerships with centers of influence. A couple of definitions are in order:

-

Thought leadership is the means of becoming the expert the wealthy want. When you and your strategic partners become thought leaders, you are recognized by the wealthy, other centers of influence and even your competitors as leading authorities in your field. As a result, you become their go-to expert.

-

Centers of influence are professional advisors to the wealthy. For you, the most important characteristic of COIs is that they serve affluent clients and, given the right partnership, actively refer them to you. COIs are your conduit to the wealthy. There are many types of professional advisors to the affluent, from investment bankers to executive coaches, but we will focus here on the two types that make the lion’s share of wealthy client referrals to financial advisors: attorneys and accountants.

-

When done well, helping your centers of influence become thought leaders deeply motivates them to pro-actively identify their qualified wealthy clients and introduce them to you, and then to lobby those clients on your behalf.

Throughout this program, we will spell out exactly how to use thought leadership to build partnerships that deliver new wealthy clients to you and substantial new revenue to your partners.

9. Conducting Discovery, Step by Step

1. Begin building rapport. Build trust and credibility with the COI by sharing best practices content designed to help him or her become more successful.

2. Get initial buy-in. Do a quick check to make sure that the COI understands the potential in working together and is interested in exploring further.

3. Describe the potential partnership. Briefly describe the pipeline process and how it will help the COI build his or her business.

4. Conduct discovery using the assessment instrument and mind mapping. Use the short video from John Bowen and Russ Alan Prince and/or the customizable two-page overview of the process.

10. Components of an Effective Agreement

The next step in building your wealthy client pipeline is creating an agreement that spells out the exact roles, responsibilities and expectations of each party. No matter how enthusiastic or motivated your partner appears, do not skip this step.

Agreements are not legal contracts or formal obligations, but they should specify your role and responsibilities and that of your partner. An agreement can be an informal memorandum of understanding signed by both parties or merely a verbal confirmation of each party’s understanding of the partnership. What matters is that the commitments of each party to the relationship are spelled out from the beginning and then revisited and reinforced on a regular basis.

Your agreement should delineate each partner’s role and commitments as well as the intended outcomes for the partnership. Your agreements will likely vary somewhat from one partner to the next depending on specific circumstances, but generally, your agreement should define these things:

Your role: To help your partner become a thought leader and, by doing so, draw in significant new business

Your Commitments:

-

To provide your partner with high-quality thought leadership content to distribute on a regular basis to clients, prospective clients and other high-value relationships

-

To provide regular guidance on the effective use and distribution of thought leadership content and on follow-up actions to take after distributing the content

-

To make it as easy as possible for your partner to refer wealthy clients to you (more about this below)

Expected outcome for your partner: A measurable increase in revenue and net profit derived from the new business the thought leadership efforts attract

Your partner’s role: To become a thought leader and refer new wealthy clients to you

Your Partner’s Commitments:

-

To endeavor to make the best possible use of the thought leadership materials you provide in order to position himself or herself as the expert the wealthy want, and thereby to attract new business

-

To actively refer to you clients who are suitable for and would potentially benefit from your services

-

To strongly advocate for you when making the referrals

Expected outcome for you: A steady stream of referrals of qualified wealthy clients

A sample of an agreement in the form of a memorandum of understanding is available for download below.

As you work with a partner and come to better understand the potential of the partnership, you may choose to refine your agreement to include more detail. For example, including the percentage increase of revenue and profit that is expected for the COI over a certain time frame can be very powerful, as can including a specific number of wealthy referrals that you expect over a certain time. Becoming proficient at projecting business increases takes time and a lot of practice, however, so begin with the basics in your agreement and refine from there as time goes on.

11. The Thought Leadership Process

Step 1: Understanding Your Partners Business Model

During your discovery meetings, you should uncover key traits of the business models of your attorney and accountant partners. These will help inform the types of thought leadership content you provide and how your partner can use the content most effectively. You will want to know these characteristics of your partners:

-

The nature of their high-net-worth clientele (for instance, a diverse group of affluent families with an average net worth of $15 million)

-

The types of wealthy clients they are most interested in pursuing (for instance, successful business owners with an average net worth of $40 million)

-

Their capabilities, especially areas where they have extensive expertise (for instance, asset protection planning)

-

The services they usually provide to high-net-worth clients (for instance, estate and income tax planning)

-

Their ability to draw on other resources of their firms (for instance, company valuation specialists)

-

The resources they have to distribute thought leadership content (for instance, their use of email and social media platforms such as Facebook, LinkedIn and Twitter)

-

The way they currently tend to get new wealthy clients (for instance, referrals from current clients and other professionals in their firm)

As we’ve mentioned, your discovery of your partners should be ongoing. You will likely expand and refine your understanding of your partners’ business models over time. With these insights in hand, you’re ready for the next step.

Step 2: Determine the Type of Expert Your Partner Wants to Be

It is much easier to help your partners position themselves as the experts the wealthy want when you focus on one or two areas of expertise and one or two types of clients. Claiming to be the expert in many areas for many types of clients is usually counterproductive and, for the most part, unbelievable.

The area of expertise can be a technical specialty, such as one of these:

-

Estate planning

-

Succession planning

-

Tax controversy

-

Business management

-

Philanthropic advisory

And these are examples of types of high-net-worth clients your partners might specialize in serving:

-

Successful entrepreneurs

-

C-level corporate executives

-

Divorced people

-

Inheritors

-

Professional athletes

Of course, a professional can combine technical specializations with client types—asset protection planning for professional musicians, for instance. Helping your partners refine their positioning as thought leaders will be useful in helping you provide them with the high-quality thought leadership content they will need.

Generally, most attorneys and accountants want to be thought leaders for fairly broad audiences. For example, an attorney may look to be a thought leader when it comes to charitable giving or, broader yet, wealth planning. These areas of expertise are potentially applicable for all wealthy families.

When accountants and attorneys are part of a firm that gives them access to additional types of expertise within the firm, you may be able to deploy thought leadership content on a wider range of topics. For example, an accountant partner may not be directly involved with assisting entrepreneurs in selling their companies, but because the firm has the knowledge and skill set to do this, sending out content on this topic can lead to more business all around.

This can be a balancing act. On the one hand, you and your partners want to be recognized as authorities in specific areas where they and you are proficient and can directly deliver the services and products involved. On the other hand, everyone wants to be responsive to the needs and wants of their wealthy clients and prospective clients.

In addition, keep in mind that while you need to skillfully position your partners as experts in specific matters, you usually will want to provide high-quality thought leadership content beyond these specialties, and not just on financial or legal matters. We have found that delivering high-quality thought leadership on health, family and lifestyle topics is extremely effective in building stronger relationships with the wealthy. Again, this is a balancing act between communicating the specific expertise of your partners and providing content of interest to affluent clients and prospective clients.

Step 3: Provide Optimal Thought Leadership Content

To become a thought leader, and to help your partners become thought leaders, you need high-quality thought leadership content—a lot of it.

What do we mean by high quality? This is content tailor-made for the wealthy to address their very specific financial, business, family, charitable and lifestyle concerns. In contrast to the old-fashioned client newsletters that focus on personal finance topics, high-quality thought leadership content is unique and relatively rare. Your ability to provide this content to your partners will make you very valuable to them.

The Advantage Connection

Your enrollment in the Wealthy Client Pipeline gives you full access to all the thought leadership content provided by CEG Advantage. This means you can focus on helping your strategic partners become more successful without having to spend the significant effort and money required to create high-quality content yourself. You will primarily share two types of content, both customizable for your partners:

-

The monthly VFO Inner Circle Flash Reports are typically devoted to topics that are of interest to a broad audience of wealthy individuals and families. These Flash Reports are usually suitable for your partners to distribute to their entire list of clients and prospective clients.

-

In contrast, the five VFO Inner Circle Special Reports made available to you every month are designed to be sent selectively to individual clients and prospective clients for whom a specific topic is of particular relevance. Your partners will likely need coaching from you in how to match the right content to the right recipients. We detail how to do that in the next section.

Step 4: Provide Guidance in Using Thought Leadership Content

Simply giving your partners even the most sensational thought leadership content is not enough. You also have to help them make the most of the materials.

The greatest value you can add at this point is to help your partners make clear connections between specific pieces of your thought leadership content and the specific individuals who would benefit from receiving them. At times it can be a bit tricky to help your partner connect these dots and match up their areas of expertise and types of clients with the appropriate high-value content, but these are also often the situations when business opportunities arise.

It can be very useful to organize your thinking by placing your high-quality thought leadership content into two buckets.

Bucket #1: Financial and Legal Content

These are topics that fall within your partners’ areas of expertise. This content is focused on addressing a specific financial or legal challenge and tends to be somewhat technical. You want to connect one type of client with a topic that addresses a financial or legal challenge common among those clients. The table below provides some examples.

It is often extremely worthwhile also to send out financial or legal content that does not directly tie to the offerings of your partner. In these cases, you will need to help your partners understand how to connect the content to their services or position the material as something valuable to the recipient.

At first glance, for example, an attorney sending out thought leadership content on the importance of personal umbrella policies will not directly benefit from doing so. The attorney, after all, does not offer umbrella policies. However, this material can start a productive conversation that makes it easy to introduce the concept of asset protection planning—a service the attorney does provide. You can be of tremendous assistance in helping your partner transition from discussing umbrella policies to talking about asset protection planning. The chart below shows how the flow of such a conversation might go.

Bucket #2: Human interest content

This content enables you and your centers of influence to connect with people on a more personal, nonbusiness basis. The examples below show you how this works.

The chart below connects the dots on how human interest material can help start conversations that have nothing directly to do with what your partners offer. It also shows how your partner can move these conversations toward new business.

In addition to helping your partners match client types and interests with specific content, help them identify situations that provide clear openings to connect clients with particular content. Does your partner have a wealthy client whose will is five years old? Deliver an article about the importance of up-to-date estate planning. Is a business owner client contemplating selling his or her business? Send a report on exit planning strategies. Are the clients affluent parents worried about the choices their grown children are making? Share an article on the importance of prenuptial agreements.

Uncovering the Key Client Issues

Identifying the right thought leadership content to send to the right individuals is not likely to come naturally to your partners, at least in the beginning. The best way to help them make these connections is simply to ask questions about their clients. You’re looking for any opening to start a conversation with clients. Here are a few examples:

-

How does this client make a living? Is he or she satisfied with it?

-

Does this client own a business? For how long? What are his or her key business challenges?

-

Is this client married, divorced, widowed?

-

Does this client have children? What ages? What are the children’s interests or challenges?

-

How long has it been since you’ve seen this client?

-

What are this client’s hobbies? How does he or she love to spend free time?

As you can see, you really want to drill down into the human issues. You want to talk about real, live people—not concepts or hypotheticals—and how your partner can add value to help them. Then identify the specific thought leadership content that would open up these conversations.

Sharing the Content Effectively

Once you and your partner have matched specific pieces of content with specific clients, help your partner to share that content in a way that will have maximum impact. We recommend two key actions:

-

Customize the content with the recipient’s name and the name, photo and contact information of your partner.

-

Send the content with a personal message that references a concern or interest of the recipient.

The document below provides an email template that your partners can customize to send content to individual clients, as well as sample emails that have been used to distribute thought leadership content.

The Advantage Connection

CEG Advantage provides online tools that enable you to easily customize the VFO Inner Circle Special Reports on behalf of centers of influence for specific recipients. We recommend that you make a team member responsible for this task each month.

In addition, CEG Advantage provides suggested email copy that your partners can use to send the VFO Inner Circle reports. We recommend that this copy be personalized for each recipient.

Step 5: Follow Up

To achieve meaningful results from distributing thought leadership content, there has to be follow-up. Your partners simply will not gain new business without making direct contact with clients and prospective clients. In fact, your partners should not send content to specific individuals unless they are willing to take the time to follow up with each recipient.

Both buckets of content described earlier provide clear opportunities for productive conversations. Financial and legal content gives your partners the chance to talk about specific services or solutions with wealthy individuals who might benefit from them. Human interest content helps your partners start conversations on specific topics that have little or nothing to do with financial or legal matters, but instead help deepen relationships with clients on a personal, nonbusiness basis—while also leaving the door open to discuss business.

These should be easy conversations. Your partner should simply contact recipients and ask whether they received the content. Did they have time to look at it? Do they have any thoughts about it? Does it make sense for them? If the particular piece of content was matched carefully with the needs or interests of that individual, the conversations should flow freely. The document below contains sample scripts for partners making these follow-up phone calls.

Step 6: Keep the Pipeline Full

Helping your centers of influence become thought leaders requires systematic, consistent campaigns. These are extended discourses between your partners and their wealthy clients and prospective clients. Your partners want these individuals to recognize the knowledge, capabilities, information, insights and expertise they offer—and that recognition usually doesn’t happen overnight. It takes some time and repeated exposure, which in turn depend on having a steady flow of “new” high-quality thought leadership content, along with your guidance on how best to use this material.

When you are instrumental to the thought leadership campaigns of your centers of influence, you deliver an amazing amount of value. In return, they refer their wealthy clients to you and keep your pipeline full. This is the law of reciprocity in action.

Absolutely essential to this consistency are regular meetings with your partners. Monthly, face-to-face meetings are usually optimal. Unless you meet on a very regular basis, the odds are slim that your partners’ thought leadership efforts will be very successful or that they will actively refer and promote you to their wealthy clients. Make these meetings a top priority.

This is what you and your partner should do at each meeting:

-

Discuss results. Talk about what has happened since your last meeting in terms of new business generated by your thought leadership efforts—both for you and for your partner. (The next section will describe the specific outcomes you will look to capture and document.)

-

Match clients to content. You will bring to each meeting your thought leadership content for the month, and your partners will bring in a list of their wealthy clients and prospective clients. (If a partner has any concern about confidentiality, individuals can be listed by their initials or first name only.) Go through the list, one individual at a time, to identify situations where there is high potential for the partner to get significant new business by starting a conversation. Then identify the content that will spark and facilitate that conversation.

-

Document activities. Get specific here. Discuss and write down which individuals will receive which content and when, and which individuals will receive a follow-up call and when. Revisit these activities at your next meeting when you discuss your results.

These meetings may feel laborious in the beginning, but they will get easier and easier over time as you and your partners become ever more adept at identifying openings for new business.

By creating a routine your partners become comfortable with, you will be able to keep their thought leadership campaigns moving smoothly forward, making it more likely that all involved will achieve the results they want.

At the conclusion of each meeting, be sure to schedule your next meeting and then follow up with an email confirming that meeting. A template for your monthly meeting email confirmations is available for download below.

Implementing the Thought Leadership Solution, Step by Step

1. Understand your partner’s business model. You will gain much of this knowledge during your initial discovery meeting, but you should continue to refine your understanding of the business model over time.

2. Determine the type of expert your partner wants to be. To effectively assist your partners in positioning themselves as thought leaders, you need to understand the types of clients they serve and the types of expertise they provide.

3. Provide optimal thought leadership content. This means high-quality content designed to address the specific concerns and interests of the affluent. You can access this content on an ongoing basis from CEG Advantage.

4. Provide guidance in using thought leadership content. Your partner will likely need coaching from you in matching the right content to the right recipients and then sharing it effectively.

5. Follow up. For everyone to get the results they want, your partner must reach out to recipients after sending them thought leadership content.

6. Keep the pipeline full. You and your partner must be extremely systematic in order to drive new business. Meet monthly to discuss your results, match clients to content and track activities.

Tracking The Results

What to Track

In any business endeavor, results matter. Are you getting the results you are looking for? Are you getting the results you need in order to keep going in a set direction? Are you getting the results you need if you are going to become significantly more successful?

When it comes to the wealthy client pipeline, there are two sets of results that matter:

-

The results you help your partners achieve. The extent to which you help your partners generate new business usually directly correlates to the effort they put into referring wealthy clients to you. The more business they get, the more referrals you should get. The results they get and the effort they put forth are very good leading indicators of the success you can potentially have.

-

The results you achieve. The bottom line: When you help your partners become thought leaders, you get a steady stream of wealthy client referrals. This makes it essential for you to know whether your chosen partners are fulfilling their end of your agreements.

Keep in mind that it’s the amount of revenue, not the number of new clients, that matters most. Three new clients, for instance, are usually better than ten new clients if the revenue is the same.

During discovery, you should get a good sense of the potential of a center of influence to refer wealthy clients to you. By diligently tracking, you can compare this potential with the actual outcome. If there’s a large gap between the two that seems unlikely to close, consider saying N.E.X.T.

Your goal is to make your attorney and accountant partners more successful by guiding them to become thought leaders. When you are clear about exactly how much value you are providing to them in terms of increased revenue, you can justifiably ask for more business in return.

Thus, your ability to garner referrals to new wealthy clients from your partners greatly depends on your ability to determine and quantify the value you bring to them. And the only way to know how important you are to your partners is to track their financial results that stem from your efforts.

Once you know the economic gains your partners enjoy from working with you, make sure you are getting appropriate economic benefits from working with each of them. It’s the norm to modify the initial agreements you created once you have a track record of producing solid financial returns.

How to Track

Your aim when tracking is not to precisely determine all the business your partners generate because you are helping them become thought leaders. The nature of becoming a thought leader over time makes this impossible. Results are not always immediate, and it’s usually not possible to tag one piece of new business to one specific piece of thought leadership content. New business that comes in over the transom due to a partner’s enhanced status as a thought leader is particularly difficult to track.

However, you certainly can track some results, and to the extent possible, you want to track the results of your partners. These results are clear when your partners send out high-quality thought leadership content and get a positive response to the material. They’re clear when partners use your thought leadership content in presentations and get a positive response. They’re also clear when partners use your content in meetings with clients and prospective clients and hear a positive response.

Usually, the only way you will know your partners are getting traction from your thought leadership content is when they tell you. Discussing their results should be a regular agenda item in your monthly meetings. Take notes on the results they share with you. Tracking results is not a science, but you can, with practice, get closer and closer to a deep understanding of how valuable you are to your partners.

A template for tracking key results is available for download below.

Step By Step

TRACKING RESULTS

1. Track two sets of results. To the extent possible, you want to track both the results that your partners achieve and those that you achieve as a result of your partnership.

2. Focus on revenue. What matters most is the amount of additional revenue coming in, not the number of new clients.

3. Document your results. Asking your partners about their results and then documenting them should be an agenda item in each of your monthly meetings.